How Much Duty Free Allowance?

What is the duty-free allowance from Canary Islands after Brexit? How many duty free goods can I take home from Gran Canaria? Duty free literally means goods that are exempt from payment of duty. The Canary Islands are one of nine EU territories that are located outside of Europe and are known as the “outermost regions” (OMR). These areas are exempt from EU customs and VAT regulations. As a result, when you buy anything in Gran Canaria, you do not have to pay VAT. Instead, the goods are taxed at a much lower, local level. The rules for importing duty-free goods purchased in Gran Canaria vary depending on the country to which you are travelling.

Upon returning you are allowed to bring home a certain amount of certain goods without having to pay duty tax. However, they must be for you or are a gift for someone else. Remember you are not allowed to sell anything that you have bought duty free.

The Canary Islands are a particular tax-free zone that is not affected by the removal of duty-free shopping within EU countries. They are a part of Spain but are not EEA members. At this place, you can purchase your duty-free items upon arrival, either in the airport or at one of the many stores on the islands that provide items at tax-free prices. Duty Free and Tax Free are privileged locations where you can frequently purchase items in the airport shops upon arrival or in the neighbourhood shops while benefiting from the tax free or duty free shopping discounts.

Locations

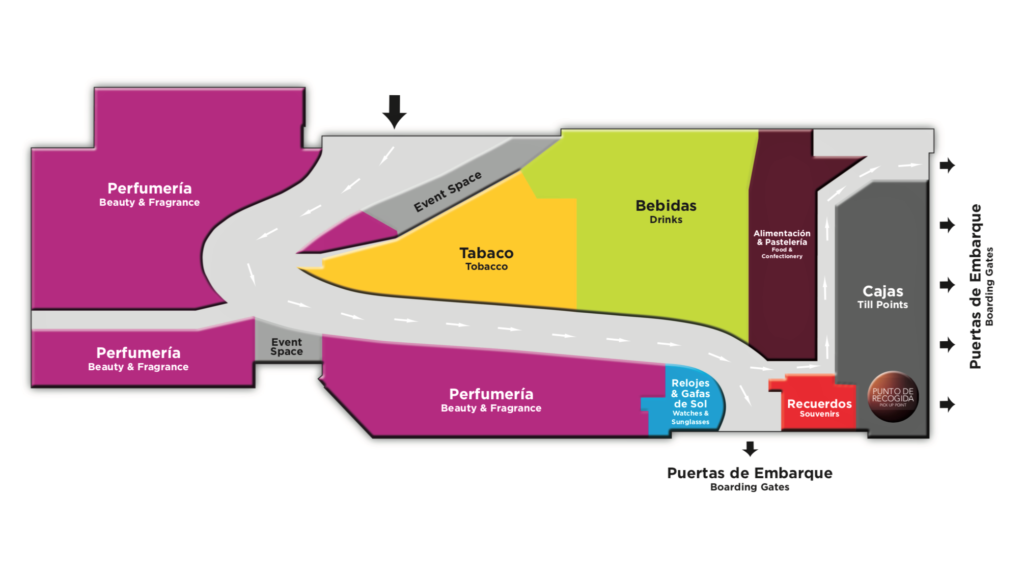

On the ground floor of the public area, you will find a supermarket. There are also a couple of duty-free Gran Canaria outlets.

On the first floor of departures, in the public area, you will find a chemist. After going through security, you will find the main outlets specialising in most duty-free products, from jewelry, alcohol, and tobacco, to some well-known fashion outlets. The opening times for the main Duty Free shop are 6am – 10pm every day. This outlet offers branded perfumes like Gucci, Dior. Single Malt Whisky from Ireland and Scotland, like Jameson and Glenfiddich.

What can I bring back from Gran Canaria and other Canary Islands as these are outside the E.U?

There is no tax to pay on certain goods that you bring back from outside of the EU. However, you cannot combine allowances with family or friends to bring in more than your individual allowance. For Duty Free Gran Canaria allowances for UK see below.

Generally, airlines allow you to take on board in addition to your hand luggage, one bag of duty free goods that you have purchased at the Duty Free shop in the airport.

Alcohol: You can bring in 16 litres of beer and 4 litres of wine (not sparkling). You can also bring in either:

2 litres of fortified wine, sparkling wine and alcoholic drinks up to 22% alcohol or 1 litre of spirits and other liquors over 22% alcohol.

It is possible to split this last allowance – for example, you could bring back half a litre of spirits and 1 litre of fortified wine (each item half of your allowance).

Tobacco: You can bring in 200 cigarettes or 100 cigarillos or 50 cigars or 250g of loose tobacco.

Again it is possible to split this allowance. For example, you could bring in 100 cigarettes and 25 cigars (both half of your allowance). Gran Canaria tobacco prices 2022 vary depending on the outlet, but you will always make substantial savings.

Allowances for other goods: You are entitled to bring back other goods worth up to euro 430. Included are perfume and souvenirs. However, if you buy a single item worth more than this then you will pay duty on its full value.

When should you declare?

You only need to declare goods to customs if you have gone over your allowance. Also if you intend to sell any of the goods or if you have any restricted items.

If you have gone over your allowance, expect to pay Customs Duty at a rate of 2.5% for items worth up to £630. If the goods are worth more than £630 you may have to pay more. Import VAT may also be added on.

Tip: Just because you’re buying something duty free doesn’t mean it’s automatically cheaper than the high street. Airport shops usually dramatically mark up the cost of items such as perfume or aftershave.

Our advice is to check out the high street price of the item you’re interested in before you travel.

What is the duty-free allowance from Canary Islands after Brexit?

Duty-free allowance for travel to Great Britain post-Brexit. If you are flying from Gran Canaria Airport to Great Britain ( England, Wales, or Scotland), the following limits apply:

Tobacco

You can bring with you one of the following tobacco products:

- 200 cigarettes

- 100 cigarillos

- 50 cigars

- 250g tobacco

- 200 sticks of tobacco for electronic heated tobacco devices

It is possible to “mix and match”, as long as you don’t go over your total allowance (e.g. you can bring with you 100 cigarettes and 25 cigars (both half of your allowance).

Alcohol

With regards to alcohol, your customs allowance by far exceeds what you will be able to carry with you in practice. Your duty-free allowance for alcohol is as follows:

A maximum of 4 litres of spirits and other liquors over 22% alcohol

OR

A maximum of 9 litres of sparkling wine, fortified wine (for example port, sherry) and other alcoholic drinks up to 22% alcohol (not including beer or still wine).

It is possible to split this allowance, e.g. you can bring 4.5 litres of fortified wine and 2 litres of spirits (both half of your allowance).

You can also bring with you:

Up to 18 litres of wine (still)

AND

Up to 42 litres of beer

Please note: If you are under 17, you have no personal allowances for tobacco or alcohol. You are permitted to bring alcohol and tobacco with you for your own use but you must pay tax and duty on these products before you arrive in the UK.

Other goods

You can bring in other goods up to the value of £390 (or up to £270 if you arrive by private plane). You may have to pay import VAT and customs duty if you exceed your allowance.

[wpc-weather id="13770" /]